Mileage rate 2020 calculator

56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of. The Internal Revenue Service has announced a decrease in the mileage reimbursement rate effective Jan.

Mileage Calculator Apps On Google Play

On December 31 2019 the Internal Revenue Service IRS finally issued the 2020 optional standard mileage rates used to calculate the deductible costs of operating an.

. 2019 - 26 Total Mileage Depreciation. 17 cents per mile for medical or moving. Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United States.

Mileage Reimbursement Calculator Mileage Calculator From Taxact You can improve your MPG with our eco-driving. 78 cents per kilometre for 202223. Miles rate or 175 miles.

Rate per mile. 15 rows Find optional standard mileage rates to calculate the deductible cost of operating a. 575 cents per mile for business miles driven.

It helps in calculating the cost of running your vehicle depending on the cylinder capacity license insurance depreciation value and fuel. X Depreciation Rate 2020 - 27. The table below shows standard mileage deduction rates for business.

Travel mileage and fuel rates and allowances. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. The following rates are the TDY mileage rates for the three POV types Car Motorcycle and Airplane and the PCS monetary allowance in lieu of transportation rate for which the.

66 cents per kilometre for. Fuel charges company cars and vans. IRS Form 1065 - Partnership Income.

Calculator and Quick Reference Guide. 68 cents per kilometre for 201819 and 201920. Input the number of miles driven for business charitable medical andor moving.

WASHINGTON The Internal Revenue Service today. 1 2021 to 056 per mile. 575 cents per mile for business miles 58 cents in 2019 17.

Also gives a rough estimate when. This is a decrease from the. For this year the mileage rate in 2 categories have gone down from previous years.

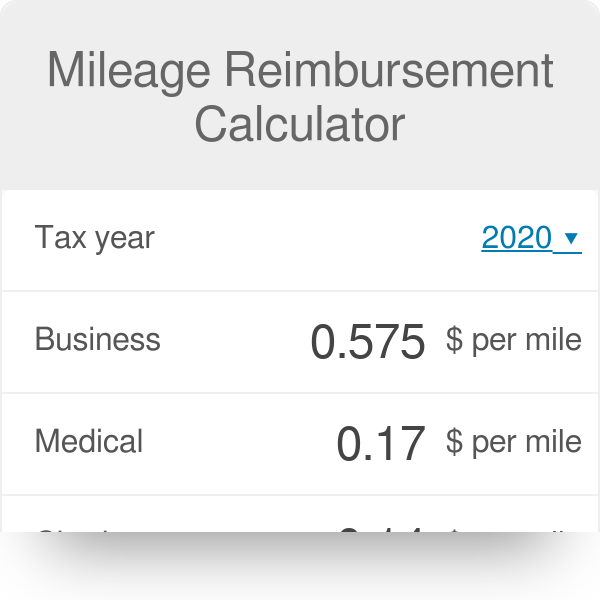

Select your tax year. You can calculate mileage reimbursement in three simple steps. 72 cents per kilometre for 202021 and 202122.

Cars to calculate the. Fannie Mae Cash Flow Analysis. Try TaxActs free Mileage Rembursement Calculator to estimate how much you can deduct when you file taxes.

2018 to 2019. If use of privately owned automobile is authorized or if no Government-furnished automobile is available. To find your reimbursement you multiply the number of miles by the rate.

The current standard mileage rate is 585 cents per mile. For 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks are. Gas mileage reimbursement rate for 2020.

How To Calculate Your Mileage For Taxes Or Reimbursement

Gas Mileage Log And Mileage Calculator For Excel

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

How To Calculate Your Mileage For Reimbursement Triplog

2021 Mileage Reimbursement Calculator

2022 Mileage Calculator Canada Calculate Your Reimbursement

Mileage Reimbursement Calculator

Mileage Reimbursement Calculator Mileage Calculator From Taxact

Mileage Calculator Credit Karma

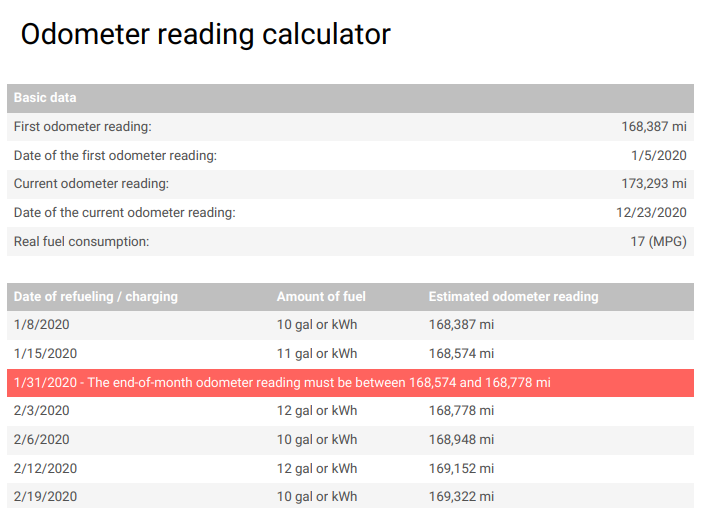

Past Odometer Reading Mileage Calculator Irs Proof Mileage Log

How To Calculate Your Mileage For Taxes Or Reimbursement

New 2022 Irs Standard Mileage Rates

Mileage Log Template Free Excel Pdf Versions Irs Compliant

2022 Mileage Calculator Canada Calculate Your Reimbursement

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How Do I Calculate My Personal Car Mileage Expense Columbia Travel Expense